This website uses cookies and is meant for marketing purposes only.

Trading major market indices has been a popular way of investing for nearly a century, but it hasn’t always been available for individual traders. Due to our advanced technology you can now trade your favorite market indices in the form of CFDs and benefit from a variety of tradable products like the Nifty 50 CFD.

CFD trading is available for all types of investors (where permitted by local regulations). Contracts for difference (CFDs) allow individual investors to trade an array of financial products, such as indices (also the Nifty 50 CFD) and commodities, without having to physically own them. CFDs mirror price movements of popular traded products, usually of future contracts, and allow individual investors to use common trading tools, such as technical analysis, fundamental analysis and well known strategies to take advantage of potential market trends.

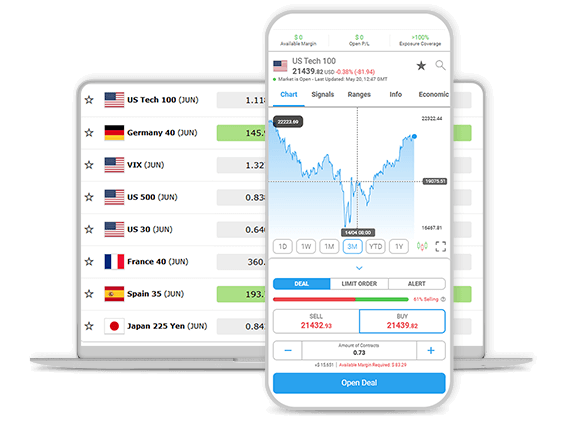

With a solid trading platform, you can review the trends and market movements of many index CFDs, including some of the world's most important indices, and make a decision to invest in their prices with a simple click or a touch. No longer do you need to open a banking investor account and have a huge starting sum, just to try and take advantage of the latest news about the S&P500, for example.

Learn more in our education center and discover the fundamentals of index trading.

To begin, it's crucial to educate oneself about the stock market and how it operates. Start by reading reputable financial news sources, investing books, and attending online webinars or classes. Familiarize yourself with the key concepts such as market order, limit order, and stop-loss order. Open a demo trading account to practice without risking real money. This hands-on experience is invaluable as it allows you to understand the dynamics of trading, including making buying and selling decisions, tracking stocks, and getting used to the trading platform.

Start by investing a small amount that you're willing to lose, as the stock market is inherently volatile and unpredictable. Diversify your investments to spread the risk – don't put all your money into one stock or sector. As a novice, it's advisable to stick to well-known companies with a history of stable earnings. Over time, as you become more experienced, you can explore more complex investment strategies and instruments. Always remember to continually educate yourself, remain patient, and avoid making decisions based on emotions. The world of share trading is vast and complex, but with dedication and the right resources, it can also be immensely rewarding.

At iFOREX, you have access to all of these tools and more, with education, demo account and access to news, making it a preferrable broker for those looking to start share trading.

Visit our economic calendar page to explore the next market event.

When trading with iFOREX, you gain access to unique features that enhance your trading experience:

Leverage up to 1:200 enabling you to trade larger positions with a smaller investment.

Tight spreads ensuring cost-effective trading.

Advanced charting tools for better market analysis.

24/5 customer support to assist you whenever needed.

Please see some of the most popular indices at iFOREX below:

Rates are according to the sell price of the index

For a full list of the Indices that you can trade at iFOREX like the Nifty 50 CFD, please click here.

At iFOREX, you can trade a wide selection of global stock indices, allowing you to speculate on the performance of entire markets instead of individual stocks. Trading index CFDs gives you exposure to major economies and sectors through a single position.

Some of the most popular indices available include:

S&P 500 Index (US 500) Tracks the performance of 500 leading U.S. companies across various sectors.

Nasdaq-100 Index (US Tech 100) Focuses on major non-financial companies, especially in technology and innovation.

Dow Jones Industrial Average (US 30) Represents 30 of the largest blue-chip companies in the U.S.

DAX40 (Germany 40) Reflects the performance of 40 top German companies listed on the Frankfurt Stock Exchange.

Nikkei225 (Japan 225) Tracks the performance of 225 leading companies on the Tokyo Stock Exchange.

Our cutting-edge trading platform is designed to meet the needs of Indian traders, offering:

Explore our platform and experience a seamless trading journey.

Start trading indices with iFOREX and enjoy our exclusive welcome package:

What is the difference between trading individual stocks and trading indices?

Trading individual stocks means you're speculating on the performance of a single company, such as Apple or Tesla. Trading indices, on the other hand, involves speculating on the overall performance of a group of companies—like the top 500 U.S. firms in the S&P 500. Indices offer instant diversification and are often used to gauge the health of entire economies or sectors, while stocks are more focused and can be influenced by company-specific news.

How does leverage work in Index CFDs?

Leverage allows you to control a larger position in an index with a relatively small capital outlay. For example, with 1:200 leverage, a $100 deposit would let you open a position worth $20,000. While this magnifies potential profits, it also increases risk, so using risk management tools like stop-loss orders is essential when trading leveraged index CFDs.

What does S&P 500 stand for?

S&P 500 stands for the Standard & Poor’s 500 Index, which tracks the performance of 500 of the largest publicly traded companies in the U.S. It is widely regarded as one of the best representations of the U.S. stock market and overall economic health.

What is the 3-5-7 rule in trading?

The 3-5-7 rule is a general guideline for setting stop-loss and take-profit levels in short-term trading. It suggests aiming for a 3% stop-loss, a 5% realistic profit target, and a 7% ideal target. While not a strict rule, it's used by some traders to structure trades with risk-reward ratios in mind. Keep in mind that these percentages should always be adjusted based on market conditions and your personal trading strategy.

Ready to start your index trading journey? Sign up now and claim your welcome package today!