This website uses cookies and is meant for marketing purposes only.

Forex currency trading are beloved instruments for day traders as they can easily leverage the movement in currency values and to minimize the risk by placing limits, stop loss & take profit, to automize the process. The forex major pairs are especially liked because it's easier to track the movements of economies in relation to the US economy, in things like money reserves which the US Dollar is the most used worldwide, and international business, with the US being the largest global economy. Traders know that a lot of powerful institution don't want to see the US Dollar specifically plummet or increase greatly in value, so they know they can gains on a daily basis.

However, if the US Dollar does fluctuate greatly due to changes in America, they can go away from forex major pairs to forex minor pairs, not trading in the major currency on the planets. The alternative forex currency can diversify a portfolio well when they are well thought of with the same limits. Some may even follow the news on the economic calendar and other sources to make exotic currencies, not often traded ones, if they can forecast well an increase or a decrease value compared to the other currency.

Learn more in our education center and discover the fundamentals of index trading.

Forex operates through a global network of banks, corporations and individuals trading one currency against another. As Forex is available on numerous exchanges across the globe, traders and investors alike can take advantage of this market, which is open on a 24 hour basis.

In addition to share trading, commodity trading, and index trading in the form of CFDs, iFOREX also offers an array of tradable currency pairs ranging from major and more popular pairs, to exotic currencies that are far less common. Most people are unaware that the Forex market is 10 times larger than any stock market, accommodates a daily trade of over $4 trillion and presents numerous opportunities for individual traders.

At iFOREX, you have access to all of these tools and more, with education, demo account and access to news, making it a preferrable broker for those looking to start share trading.

Visit our economic calendar page to explore the next market event.

When trading with iFOREX, you gain access to unique features that enhance your trading experience:

Leverage up to 1:400 enabling you to trade larger positions with a smaller investment.

Tight spreads ensuring cost-effective trading.

Advanced charting tools for better market analysis.

24/5 customer support to assist you whenever needed.

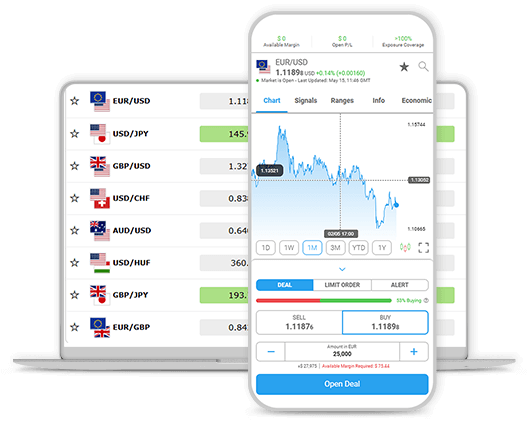

At iFOREX, you can trade a broad range of global currency pairs (forex), allowing you to speculate on the strength of one currency against another. Trading forex CFDs gives you access to the world’s most liquid market, with opportunities available 24/5. Whether you're interested in major pairs, minors, or exotics, iFOREX offers competitive conditions and real-time trading tools. Some of the most popular currency pairs available include:

EUR/USD The euro versus the U.S. dollar, and the most traded currency pair globally.

GBP/USD The British pound against the U.S. dollar, often influenced by UK and U.S. economic data.

USD/JPY The U.S. dollar against the Japanese yen, a popular pair for those watching Asian markets.

USD/INR The U.S. dollar versus the Indian rupee, commonly traded in emerging markets.

EUR/TRY The euro against the Turkish lira, offering higher volatility for more advanced traders.

Our cutting-edge trading platform is designed to meet the needs of Indian traders, offering:

Explore our platform and experience a seamless trading journey.

Start trading ETFs with iFOREX and enjoy our exclusive welcome package:

What is forex trading?

Currency trading, or FX trading, also known as forex (foreign exchange) trading, involves buying one currency while simultaneously selling another in order to profit from price movements. It’s the world’s largest financial market, with over $7 trillion traded daily.

What are forex currency pairs and how do they work?

Currencies are traded in pairs—such as EUR/USD—where the first currency (EUR) is the base and the second (USD) is the quote. When you trade a pair, you're speculating whether the base currency will rise or fall against the quote currency.

What are major, minor, and exotic currency pairs?

Major pairs include the most traded currencies like EUR/USD, GBP/USD, and USD/JPY.

Minor pairs are less liquid and don’t involve the U.S. dollar, like EUR/GBP or AUD/NZD.

Exotic pairs combine a major currency with one from a developing or smaller economy, such as USD/INR or EUR/TRY.

How does leverage work in FX trading?

Leverage allows you to control a larger position with a smaller amount of capital. For example, with 1:400 leverage, a $100 deposit could control a $40,000 trade. While leverage can amplify profits, it also increases risk—so it’s important to use it wisely with proper risk management.

When is the forex market open?

The forex market is open 24 hours a day, 5 days a week. Trading begins on Sunday evening with the opening of the Asia-Pacific markets and ends on Friday evening when the New York market closes.

What tools can help me with forex trading?

With iFOREX, you’ll have access to real-time charts, economic calendars, live trading signals, technical indicators, and exclusive tools like Pulse and Today's Opportunity to help you analyze trends and spot potential trading setups.

How do you trade with leverage?

Trading with leverage means you can open larger positions using a smaller amount of your own capital. For example, with 1:100 leverage, a $100 deposit lets you control a $10,000 trade. Leverage amplifies both potential profits and losses, so it’s essential to manage your risk using tools like stop-loss orders and position sizing.

When is the forex market open for trading?

The forex market operates 24 hours a day, 5 days a week. It opens on Sunday evening (GMT) with the Asia-Pacific session and closes on Friday evening with the New York session. This around-the-clock schedule allows traders to respond to global events in real time.

What is a pip in forex trading?

A pip (short for “percentage in point”) is the standard unit of measurement for price movement in forex. For most currency pairs, one pip equals 0.0001. So if EUR/USD moves from 1.1000 to 1.1005, that’s a 5-pip change. Pips help traders measure profits, losses, and market volatility.

What are the most popular currency pairs to trade?

The most commonly traded currency pairs - known as majors - include:

EUR/USD - Euro vs. U.S. dollar

USD/JPY - U.S. dollar vs. Japanese yen

GBP/USD - British pound vs. U.S. dollar

USD/CHF - U.S. dollar vs. Swiss franc

These pairs offer high liquidity, tight spreads, and strong trading volumes, making them ideal for many forex traders.

Ready to start your currency trading journey? Sign up now and claim your welcome package today!