This website uses cookies and is meant for marketing purposes only.

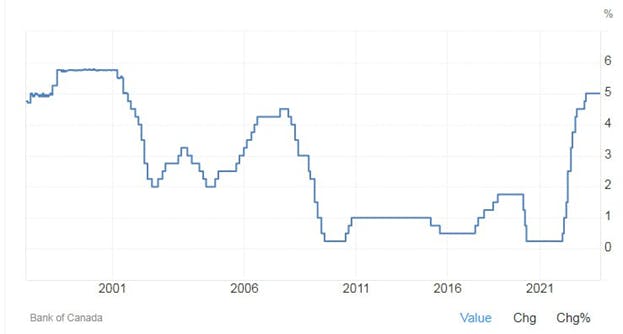

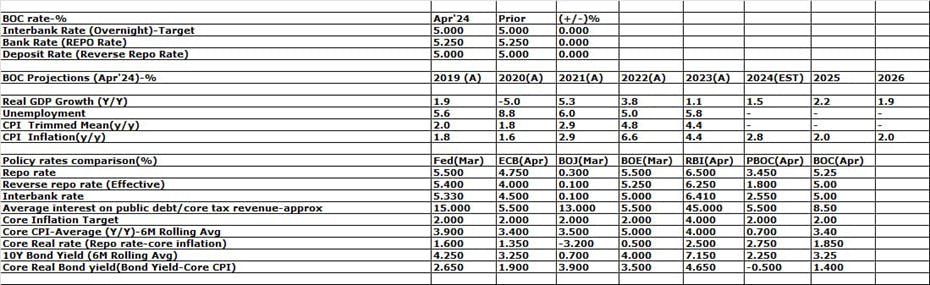

On Wednesday (10th April) some market focus was on the Bank of Canada (BOC) policy decision. As unanimously expected, BOC kept all three policy rates on hold; i.e. target for the overnight interbank rate to +5.00%; bank rate (repo rate) to +5.25% and deposit rate (reverse repo rate) to +5.00%. The BOC refrained from giving any hints (specific forward guidance) on the start of rate cuts due to persistent upside risks to inflation.

The BOC noted that underlying price pressures have eased across a broad range of goods and services since the last meeting, but added that the uncertain macroeconomic backdrop and higher-than-expected commodity prices, including oil, prevent a smoother convergence of disinflation. The BOC Governor Macklem added that although the latest data pointed to some progress in moderating underlying inflation, the data is still not sufficient to confidently warrant looser monetary policy.

Now the BOC expects headline CPI inflation to remain near the 3% level in H1CY24 and, 2.5% in H2CY24 on an average before reaching the target of 2% by 2025. In the meantime, recent data pointing to resilient global economic growth drove policymakers to consider stronger domestic output, with GDP set to expand by 1.5% this year and 2.2% in 2025

“We are Canada's central bank. We work to preserve the value of money by keeping inflation low and stable.”

Full text of BOC statement: 10th Apr’24

“The Bank of Canada today held its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening.

The Bank expects the global economy to continue growing at a rate of about 3%, with inflation in most advanced economies easing gradually. The US economy has again proven stronger than anticipated, buoyed by resilient consumption and robust business and government spending. US GDP growth is expected to slow in the second half of this year, but remain stronger than forecast in January. The euro area is projected to gradually recover from current weak growth. Global oil prices have moved up, averaging about $5 higher than assumed in the January Monetary Policy Report (MPR). Since January, bond yields have increased but, with narrower corporate credit spreads and sharply higher equity markets, overall financial conditions have eased.

The Bank has revised its forecast for global GDP growth to 2¾% in 2024 and about 3% in 2025 and 2026. Inflation continues to slow across most advanced economies, although progress will likely be bumpy. Inflation rates are projected to reach central bank targets in 2025.

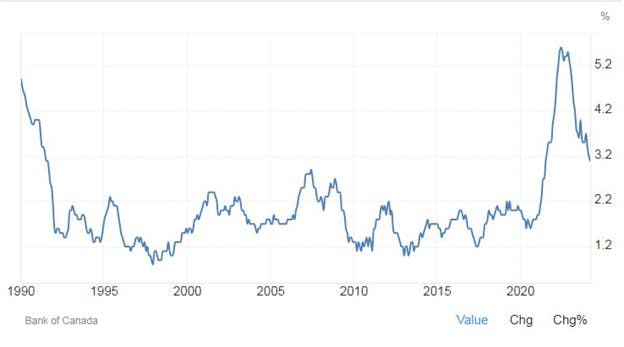

In Canada, economic growth stalled in the second half of last year and the economy moved into excess supply. A broad range of indicators suggests that labor market conditions continue to ease. Employment has been growing more slowly than the working-age population and the unemployment rate has risen gradually, reaching 6.1% in March. There are some recent signs that wage pressures are moderating.

Economic growth is forecast to pick up in 2024. This largely reflects both strong population growth and a recovery in spending by households. Residential investment is strengthening, responding to continued robust demand for housing. The contribution to growth from spending by governments has also increased. Business investment is projected to recover gradually after considerable weakness in the second half of last year. The Bank expects exports to continue to grow solidly through 2024.

Overall, the Bank forecasts GDP growth of 1.5% in 2024, 2.2% in 2025, and 1.9% in 2026. The strengthening economy will gradually absorb excess supply through 2025 and into 2026.

CPI inflation slowed to 2.8% in February, with easing in price pressures becoming more broad-based across goods and services. However, shelter price inflation is still very elevated, driven by growth in rent and mortgage interest costs. Core measures of inflation, which had been running around 3½%, slowed to just over 3% in February, and 3-month annualized rates are suggesting downward momentum. The Bank expects CPI inflation to be close to 3% during the first half of this year, move below 2½% in the second half, and reach the 2% inflation target in 2025.

Based on the outlook, the Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. While inflation is still too high and risks remain, CPI and core inflation have eased further in recent months. The Council will be looking for evidence that this downward momentum is sustained. The Governing Council is particularly watching the evolution of core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior. The Bank remains resolute in its commitment to restoring price stability for Canadians.”

The opening statement of BOC Governor Macklem: 10th Apr’24

Good morning. I’m pleased to be here with Senior Deputy Governor Carolyn Rogers to discuss today’s policy announcement and our Monetary Policy Report.

Today, we maintained our policy interest rate at 5%. We are also continuing our policy of quantitative tightening.

We have three main messages this morning.

First, monetary policy is working. Total consumer price index (CPI) and core inflation have eased further in recent months, and we expect inflation to continue to move closer to the 2% target this year.

Second, growth in the economy looks to be picking up. We expect GDP growth to be solid this year and to strengthen further in 2025.

Third, as we consider how much longer to hold the policy rate at the current level, we’re looking for evidence that the recent further easing in underlying inflation will be sustained.

Before taking your questions, let me take a moment to discuss how the economy is evolving.

We have revised our outlook for global growth. US economic growth again exceeded expectations, and while growth is expected to slow later this year, economic activity is stronger than previously forecast.

In Canada, growth stalled in the second half of last year and the economy moved into excess supply. The labor market also cooled from very overheated levels. With employment growing more slowly than the working-age population, the unemployment rate has risen gradually over the last year to 6.1% in March. There are also some signs that wage pressures are beginning to ease.

Economic growth is forecast to strengthen in 2024. Strong population growth is increasing consumer demand as well as the supply of workers, and spending by households is forecast to recover through the year. Spending by governments also contributes to growth, and US strength supports Canadian exports.

Overall, we forecast GDP growth in Canada of 1.5% this year and about 2% in 2025 and 2026. The strengthening economy will gradually absorb excess supply through 2025 and into 2026.

CPI inflation eased to 2.8% in February, and price increases are now slowing across most major categories. Inflation rates for durable goods, clothing, food, and services such as recreation and travel have all declined. However, shelter cost inflation is still very high and remains the biggest contributor to overall inflation. Some other services, like restaurant meals, also remain persistently high.

Looking ahead, we expect core inflation to continue to ease gradually. The more timely three-month rates of core inflation fell below 3% in February, suggesting some downward momentum. But with gasoline prices rising, CPI inflation is likely to remain around 3% in the coming months. It is then expected to ease below 2½% in the second half of this year and reach the 2% target in 2025.

As always, there are risks around our forecast. Inflation could be higher if global tensions escalate and this boosts energy prices and further disrupts international shipping. House prices in Canada could rise faster than expected. And wage growth could remain high relative to productivity. On the downside, economic activity globally and in Canada could be weaker than expected, cooling demand and inflation too much.

We don’t want to leave monetary policy this restrictive longer than we need to. But if we lower our policy interest rate too early or cut too fast, we could jeopardize the progress we’ve made in bringing inflation down.

Based on our forecast and the risks, the Governing Council decided it was appropriate to maintain the policy rate at 5%.

We also concluded that, overall, the data since January have increased our confidence that inflation will continue to come down gradually even as economic activity strengthens. Our key indicators of inflation have all moved in the right direction and recent data point to a pickup in economic growth.

I realize that what most Canadians want to know is when we will lower our policy interest rate. What do we need to see to be convinced it’s time to cut? The short answer is we are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained. The further decline we’ve seen in core inflation is very recent. We need to be assured this is not just a temporary dip.

In the months ahead, we will be closely watching the evolution of core inflation. We remain focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior as indicators of where inflation is headed.

To conclude, we’ve come a long way in the fight against inflation, and recent progress is encouraging. We want to see this progress sustained.

With that summary, the Senior Deputy Governor and I would be pleased to take your questions.

Highlights of BOC Presser (Q&A) comments by BOC Governor Macklem: 10th Apr’24

· BoC Rate Decision Actual 5% (Forecast 5%, Previous 5.00%)

· Inflation to average 2.6% in 2024 (vs 2.8% in January), 2.2% in 2025 (unchanged), 2.1% in 2026

· Bank of Canada revises 2024 growth forecast up to 1.5% (vs 0.8% in January), 2.2% in 2025 (vs 2.4%), 1.9% in 2026

· Shelter cost inflation is still very high and some other services remain persistently high

· Higher gasoline prices are expected to keep CPI inflation close to 3% in Q2 of 2024 before it eases to below 2.5% in H2

· Annualized Q4 GDP seen at 1.0% (vs 0.0% in January), Q1 2024 2.8% (vs 0.5%), Q2 1.5%

· Bank of Canada is increasingly confident that inflation will continue to come down gradually even as economic activity strengthens

· Monetary policy is working and growth in the economy looks to be picking up

· We expect core inflation to continue to ease gradually

· As the Bank of Canada considers how much longer to keep rates at 5%, it is looking for evidence that recent further easing in underlying inflation will be sustained

· BOC reiterates that it is focusing on the balance between supply and demand, inflation expectations, wage growth and corporate pricing behavior

· The further decline we've seen in core inflation is very recent; we need to be assured it is not a temporary dip

· CPI seen close to 3% during h1 2024, moving below 2.5% in h2 2024 and reaching the 2% target in 2025

· With gasoline prices rising, CPI is likely to remain around 3% in the coming months

· The Q1 output gap is estimated to be between -0.5% to -1.5%; potential output growth is expected to slow from 2.5% in 2024 to about 1.6% on average over 2025 and 2026

· For current wage growth to become compatible with the 2% inflation target, productivity growth would need to increase substantially

· The nominal neutral interest rate is estimated to be in the range of 2.25% to 3.25%, (up 25 basis points from January)

· The bank views risks to the inflation outlook to be balanced and is more concerned about the upside risks

· The start of commercial operations for the trans mountain expansion project is expected to add roughly a quarter of a percentage point to q2 GDP growth

· Inflation is expected to return to 2% target near the end of 2025

· The Canadian economy is expected to return to balance in 2026; potential output growth in 2024 is robust, reflecting strong immigration

· Inflation to average 2.6% in 2024 (vs 2.8% in January), 2.2% in 2025 (unchanged), 2.1% in 2026

· Shelter cost inflation is still very high and some other services remain persistently high

· Monetary policy is working and growth in the economy looks to be picking up

· We expect core inflation to continue to ease gradually

· June rate cut is possible

Further on 17th April, the BOC Governor Macklem said in an interaction with Fed Chair Powell in an economic conclave:

· Supply has played a much bigger role than we're used to

· We're looking for evidence that's going to be sustained

· There's some downward momentum in underlying inflation

· The last few Canada inflation readings are "reasonably good"

· I think the strength in the first quarter will be sustained through 2024

· Monetary policy is having more traction in Canada

· We continue to move in the right direction on inflation

· The downtick in core inflation suggests pressures easing

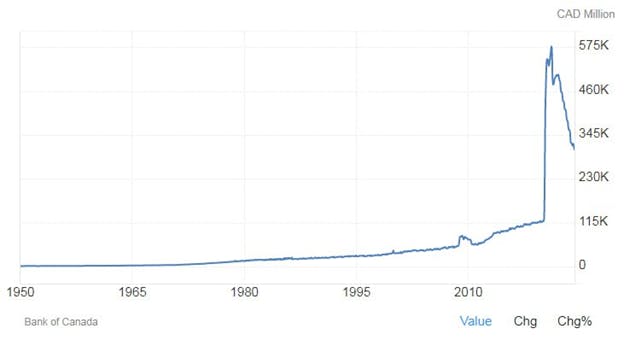

Canada is a small, but rich economy of around CAD 2.35T ($1.72T) real GDP with a population of only around 40.8M and a high Nominal GDP/Capita of $45200; nominal GDP of $2.15T in 2023. The BOC B/S size scaled a high of around CAD 576B in Feb’21 after COVID QE and then QT started from Apr’22, reducing the B/S size to around CAD 300B by Mar’24; i.e. a reduction of around CAD 276B over 12-months at an average rate of -23B CAD/Month. At present, the bank settlement (repo) balance is around 100B CAD and BOC wants to keep around 40B CAD levels (20-60B range) on average in the longer term to ensure ample liquidity for the Canadian money/funding/repo market.

The BOC may keep the overall B/S size around 240B CAD, which would be around 8% of CY24's projected nominal GDP of 3T CAD from the present (Mar’24) level of 300B CAD. The BOC may reduce the pace of QT from around 20B CAD to 5B CAD per month (QT tapering) and close the QT by H1CY25. Alternately, BOC may also keep the QT tapering pace at 10B CAD/M to close the QT by Dec’24-Mar’25 (in line with Fed) before going for any rate cuts.

In late 2023, there was some turbulence in the Canadian money market (QT tantrum like in late 2019 in the US), which forced BOC to launch a temporary small QE/OMO to tackle the tight liquidity situation. The market expectations of early rate cuts by global central banks including BOC and subsequent likely higher demand for loans/funds by banks may have caused higher demand for repo funds.

The BOC said about QT:

· The recent pressures didn’t change our view of the level of settlement balances needed in a floor system. But we are aware there is a risk that we could be wrong about the $20 billion to $60 billion range. There is uncertainty because it is fundamentally difficult to assess the demand for settlement balances

· While we have confidence that daily auctions of excess government cash and our overnight repo operations can counteract temporary funding pressures, you may be wondering what would drive us to decide to end QT early. I want to emphasize that we would announce any action involving the normalization of our balance sheet very clearly and ahead of time

· We have also said that balance sheet normalization will likely continue once inflation is on a sustainable path to 2% and we have started cutting our policy rate. This, of course, applies only while our policy rate remains in what we view to be restrictive territory

· On the other hand, if the economy slowed sharply, we would likely need to be adding monetary stimulus. In that situation, we would probably be cutting rates quickly, likely into stimulative territory and, as such, we’d stop QT, at least temporarily

· The bottom line is the balance sheet normalization process is continuing as we laid out last year, and we have tools to manage any temporary funding pressures that might come up along the way

· We have come a long way in normalizing the Bank of Canada’s balance sheet. We are getting close to the new normal. But we’re not there yet

· Normalization of our balance sheet will carry on as we work toward the $20 billion to $60 billion range for settlement balances

· We are also confident that QT was not a main driver of the pressures we saw in overnight repo markets earlier this year. But we recognize there is a risk that QT may need to end earlier than expected

· Meanwhile, the Bank has standard operating procedures for any temporary funding pressures that come up. We will be watching funding markets closely for any pressures that could be longer lasting and that, as such, could warrant a rethink of our balance sheet normalization

· Once QT is done and we have resumed our routine balance sheet management, including asset purchases, there will be a few small differences compared with how we did things before the pandemic. And, during the transition for the first number of years, we will work to replenish our money market instruments and restore a greater mix of assets and maturities on our balance sheet

· Market participants can count on us to communicate any changes in QT or our balance sheet management policy more broadly. All Canadians can count on us to manage our balance sheet in a way that lets us achieve our policy mandate as intended and promote a stable and efficient financial system

Like the Fed, the BOC is also ensuring enough banking/funding/money market liquidity through ON RRP-like tools; i.e. regular OMO operations on both sides. BOC is a mini version of its neighbor Fed, the world’s largest and systematically most important Central Bank. Like BOC, the Fed may continue two contra tools of rate cuts and also QT; even at a reduced pace as long as the policy/repo rate is in the restrictive territory as per the bank’s judgment. In case there is a sign of another financial stress like a drastic fall in employment rate, both the Fed and BOC may go for drastic rate cuts with even small QEs and only in that case it will abruptly stop QT/Balance Sheet (B/S) normalization permanently (for the cycle) or at least temporarily.

On 24th Apr’24 (Wednesday), BOC minutes for the 10th April meeting shows:

· Some members felt there was a risk of keeping monetary policy more restrictive than needed, given the decline in inflation

· There were different views on how much more assurance was needed to be confident that inflation was on a sustainable path back to the 2% target

· Ahead of the April 10th rate announcement, the governing council agreed that any monetary policy easing would probably be gradual

· The governing council was split over when to cut rates

Like the U.S. economy, the Canadian economy, and labor market, as well as core inflation, are also cooling down, but still, running quite hot, and average inflation is also above the +2.00% targets; overall disinflation process gathered momentum more in Canada than in US, but BOC is quite cautious as this may be temporary. Thus like the Fed, the BOC also needs more confidence about the sustainability of the disinflation process to avoid policy flip-flops.

As per Taylor’s rule, for the US/Canada:

Recommended policy rate (I) = A+B+(C+D)*(E-B) =0.00+2.00+ (0+0)*(4.5-2.00) =0+2+2.5=4.50% (By Dec’24)

Here:

A=desired real interest rate=0.00; B= inflation target =2.00; C= permissible factor from deviation of inflation target=0; D= permissible factor from deviation of output target from potential=0.00; E= average core inflation=4.5% (for 2023)

But if Fed does not go for the rate cut cycle from Sep’24 due to a slower disinflation process, QT ending issues (as rate cuts and QT are opposite/contra tools despite overall policy may be in the restrictive zone) and Nov’24 US election political bias issues (rate cuts just ahead of Election may be positive for Biden’s re-election prospect0, Fed may not go for any rate cuts Before Dec’24 or even in 2024. Also, core inflation may spike in the coming months as Putin may ensure oil hovering around the $100 panic zone just/months before the US election to topple Biden’s re-election prospect (conspiracy theory). In that scenario, BOC has also to follow the Fed and go for rate cuts from Mar’25 before ending the QT (B/S normalization). Fed has to prepare the market well in advance (at least 1-2 months earlier) by jawboning.

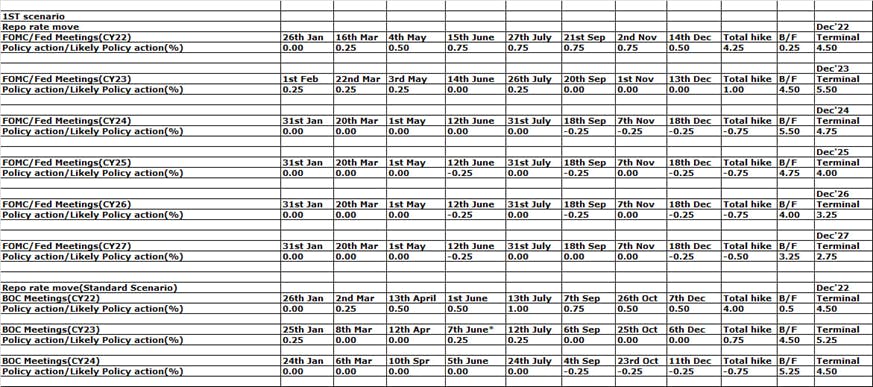

Now, the BOC will have to follow the Fed’s policy action to maintain the present policy parity (+25 bps) whatever may be the inflation/economic/employment narrative of Canada, everything being equal. If the Fed goes for -75 bps rate cuts in H2CY24, most probably from Sep’24, then BOC will have no other option but to follow the Fed and cut rates in September, October and December by -75 bps. On 10th April, after the BOC, the money market SWAPS indicated a lower probability of a June rate cut and a higher probability of a September rate cut.

The Canadian economy is largely dependent on the US import of natural resources and also the US/Chinese export of consumer goods. Canada has also a big issue of oil transportation to the other side of the Atlantic or Pacific and thus exports most of the oil to the neighboring US at a big discount. Thus Canada has to keep a stable currency for trade equilibrium and can’t diverge too much from the Fed, everything being equal.

Looking ahead, whatever may be the narrative, technically USDCAD (1.36800) now has to sustain over 1.36500 for any recovery to 1.37500/1.38000-1.38500/1.39700-1.40000 (red line); otherwise sustaining below 1.36500, may further fall to 1.36000/1.35000-1.34700/1.34200 and further 1.33500-1.31800 in the coming days.

The materials contained on this document are not made by iFOREX but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.