This website uses cookies and is meant for marketing purposes only.

Wall Street was almost flat amid hopes & hypes of Gaza war ceasefire being actively persuaded by the U.S. Ahead of Ramadan-Eid Thursday and Nov’24 election, Biden is now feeling immense public (especially Muslim voters) pressure for an immediate Gaza war ceasefire amid increasing Israeli atrocities on ordinary civilians including international aid workers. Late Tuesday, Biden called for an immediate Gaza war ceasefire in an interview recorded last week. Biden said:

· As Muslim families and communities come together for Eid al-Fitr, they are also reflecting on the pain felt by so many. My thoughts are with those around the world enduring conflict, hunger, and displacement, including in places such as Gaza and Sudan. Now is the time to recommit to the work of building peace and standing for the dignity of all

· Biden also called for a six to eight-week ceasefire

· I don’t agree with his [Netanyahu’s] approach. I think it’s outrageous that those three vehicles were hit by drones and taken out

· What I’m calling for the Israelis to just call for a ceasefire for the next six to eight weeks and allow total access to all food and medicine going into the country. I’ve spoken to everyone from the Saudis to the Jordanians to the Egyptians. They’re prepared to move this food in. There’s no excuse to not provide for the medical and food needs of those people. It should be done now

On Tuesday, the US Secretary of State Blinken said: “We have an offer for Hamas, says it's a very serious offer and should be accepted”. But it seems both Israel and Hamas are not very much interested. Israel's PM Netanyahu said: “A date has been set for a Rafah invasion in Gaza”, while the Israeli defense minister contradicted his PM and told the US secretary of defense that Israel has not yet set a date for an operation in Rafah. On the other side, Hamas’ senior official Ali Baraka said: “Hamas rejects latest Israeli ceasefire proposal”. In this way, the U.S. is still trying hard along with ME allies to ensure the announcement of the Gaza war ceasefire by Muslim Ramadan Eid day.

On Friday, Wall Street Futures, Gold, and US bonds slid, while USD surged on hotter than expected US NFP/BLS job report; Gold slid from around 2300 to around 2280 but soon jumped to around 2332 and then almost 2363 in early European session Wednesday on haven flow amid the concern that Iran may soon launch the retaliatory missile/drone attack on Israel either directly or through some proxies (like Hezbollah, Houthi etc). Gold is also getting a boost from growing geopolitical tension over the Gaza War/Israel-Iran, Russia-Ukraine war, China-Taiwan tension and a small WWW-III. Also, the never-ending US (USD) deficit, debt, devaluation, hopes of an early end of Fed’s QT and deeper rate cuts in 2025-26 (under President Trump?) are supporting the Yellow metal. Gold is also getting a boost from Central Bank buying like PBOC (China), RBI (India) and others amid a strategy to diversify FX assets.

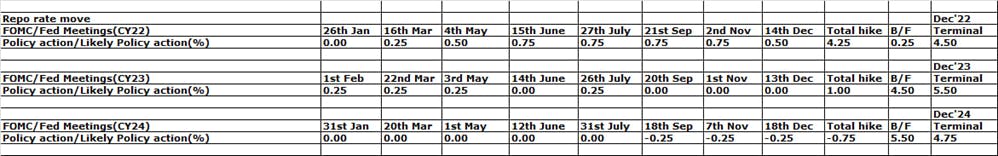

Although the market was expecting an earlier & deeper Fed rate cut of 150 bps from March/May’24, various Fed policymakers including Chair Powell are now carefully jawboning the market in a well-planned (co-ordinated) manner to control inflation expectations and also bond yields for the intended soft & safe landing of the Wall/Real street (economy) ahead of Nov’24 U.S. Presidential election. The market was expecting Fed rate cuts from Sep’24 after hotter-than-expected US NFP/BLS job data, but some market participants were also expecting Fed rate cuts from June’24.

On Wednesday, all focus of the market was on U.S. core CPI inflation for February as it may influence the Fed for any rate action/policy stance in May-June/subsequent months. Although the market is already discounting a pause for the May meeting, the Fed may still evaluate core CPI data for March along with the 2023 average and 6M rolling average (H1CY24) for policy stance in H2CY24.

On Wednesday, the BLS data showed the annual (y/y) US core inflation (seasonally not adjusted core CPI) unchanged at +3.8% in Mar’24 from +3.8% sequentially, above the market consensus of +3.7% and at the lowest almost at 3-years. In Jan’23, the annual core CPI was +5.6%.

In Mar’24, the US core CPI was boosted by the shelter index, which increased by +5.7%, accounting for over 60% of the total 12-month increase, the same rate as in February. Other indexes with notable increases over the last year include motor vehicle insurance (+22.2%), medical care (+2.2%), recreation (+1.8%), and personal care (+4.2%), while dragged by Airline fares (-7.1%).

The U.S. Core service inflation (w/o energy service) increased by +5.4% in Mar’24 from +5.2% sequentially and Jan’23 reading of +7.2%, it’s still substantially above pre-COVID average levels of 2.8%. Fed is now closely focusing on core service inflation, which is still quite elevated and sticky.

On Tuesday, the BLS data showed the sequential (m/m) US core CPI (seasonally adjusted) rose +0.4% in Mar’24, unchanged from +0.4% in Feb’24/Jan’24, above market expectations of +0.3% advance, and the sharpest increase in sequential core CPI inflation since Apr’23. In Mar’24, the sequential core CPI was boosted by transportation services (1.5% vs 1.4% in February) and apparel (0.7% vs 0.6%), while they remained high for shelter (0.5% vs 0.5%) and rebounded for medical care services (0.6% vs -0.1%).

Overall, the average of US core CPI was around +3.8% in 2024 (YTD); and +4.8% in 2023 against +6.2% in 2022, while the 6M rolling average is now around +4.0% (y/y). The annualized rate of 6M rolling average of sequential (m/m) core CPI is also around +3.9%, still substantially above the Fed’s +2.0% targets, although cooled almost -100 bps from 2023 average levels, the disinflation process has been stalled in Q1CY24, keeping Fed opting for higher for longer policy.

As per core CPI data trend, the US core PCE inflation may also increase by around +0.4% in Mar’24, resulting in an annual rate of around +2.85% and a 6M rolling average of around +3.00%. The 6M rolling average of US core inflation (PCE+CPI) is now around +3.5%.

Also, the annual inflation (total CPI) rate in the US rose to +3.5% in Mar’24 from +3.2% sequentially, higher than median forecasts of +3.4% and highest since Sep’23. In Mar’24, the US CPI was boosted by Energy costs rose 2.1% (vs -1.9% in February), with gasoline increasing 1.3% (vs -3.9%) while utility gas service (-3.2% vs -8.8%) and fuel oil (-3.7% vs -5.4%) fell less.

In Mar’24, inflation steadied for food (+2.2%) and shelter (+5.7%) but rose sharply for transportation (10.7% vs 9.9%) and apparel (0.4% vs 0%). On the other hand, prices declined for new vehicles (-0.1% vs 0.4%) and used cars and trucks (-2.2% vs -1.8%).

Overall, the US core disinflation has been stalled in Q1CY24, which may keep the Fed on hold till at least Q2CY24 and may go for any rate cuts from Sep’24 for -75 bps or even from Oct’24 (in Q4CY24) for -50 bps rate cuts in 2024.

On Tuesday, Fed’s Bostic said:

· It's always possible the Fed's growth forecast could rise

· CPI coming in at consensus would be a welcome development

· I expect a slow pace of disinflation in 2024

· I can't eliminate the possibility that rate cuts move even further out

· If the disinflation pace resumes, could pull cuts forward

· Right now businesses don't expect much damage to the labor market as demand slows

· If a labor ‘cliff’ seems to be approaching it might influence policy

· If job data signals pain to come, I would be open to earlier cuts

· Demand for services is still quite high

On Monday, Chicago Fed’s President Goolsbee said:

· Fed lender of last resort system functioning well

· The economy was on the golden path in 2023

· The economy remains strong and jobs data confirms that

· The Fed has to determine how long to be restrictive on monetary policy

· The US economy is looking like a normal boom time.

· The economy getting back into a better balance

· Jobless Rate To Eventually Rise If Rates Stay High

The Fed may go for -75 bps rate cuts in September, November, and December’24. By 18th September (Fed MPC date), the Fed will have complete data for core inflation and also unemployment/real GDP data for H1CY24 and also Aug/July’24 to have the required ‘higher confidence’ to go for rate cuts. Fed may bring down the repo rate to +4.75% by Dec’24 from present +5.50%.

The 6M rolling average of US core inflation (PCE+CPI) is now around +3.5%. Fed may cut 75 bps in H2CY24 if the 6M rolling average of core inflation (PCE+CPI) indeed eased further to +3.0% by H1CY24.

As per Taylor’s rule, for the US:

Recommended policy repo rate (I) = A+B+(C-D)*(E-B)

=1.50+2.00+ (2.60-2.00)*(4.50.00-2.00) =1.00+2+ (0.60*2.50) = 3.00+1.50=4.50% (By Dec’24)

Here:

A=desired real interest rate=1.50; B= inflation target =2.00; C= Actual real GDP growth rate for CY23=2.6; D= Real GDP growth rate target/potential=2.00; E= average core CPI+PCE inflation for CY23=4.50

Fed may announce a plan for QT tapering/closing in the May meeting and should have closed the same before going for rate cuts in H2CY24. Fed, the world’s most important central bank may not continue QT (even at a reduced pace) and go for rate cuts at the same time as QT, and rate cuts are contradictory, although Fed/Powell kept the option open, at least theoretically. Thus assuming an absurd/bizarre phenomenon, the Fed may go for -75 bps rate cuts in H2CY24, most probably from Sep’24 after deciding about the possible B/S size to ensure money market stability

Looking ahead, the Fed may keep B/S size around $6.55T, around pre-COVID levels to ensure financial/Wall Street stability along with Main Street stability (price stability and employment stability). Fed’s B/S size is presently around $7.50T (Mar’24 end). Depending upon the actual rate/reaction in the repo/funding market, the Fed may taper the QT from the present $0.095T/M to 0.050-0.075T/M for 20-12 months from May’24;i.e. Fed may end the QT by May’25-Dec’25 at B/S size around $6.55T. This is lower than the earlier market estimate of $7.00T and thus should be seen as more hawkish. Also, rate cuts along with QT (even with slower pace/tapering) should be less hawkish.

Ahead of the Nov’23 U.S. Presidential election, White House/Biden/Fed/Powell is more concerned about elevated inflation rather than the labor market; prices of essential goods & services are still significantly higher (around +20%) than pre-COVID levels, which is creating some incumbency wave (dissatisfaction) among general voters against Biden admin (Democrats).

Thus Fed is now giving more priority to price stability than employment (which is still hovering below the 4% red line) and is not ready to cut rates early as it may again cause higher inflation just ahead of the November election. Fed may hike only from Septenber’24, which will ensure no inflation spike just ahead of the Nov’24 election (as any rate action usually takes 6-12 months to transmit in the real economy), while boosting up both Wall Street and also Main Street (investors/traders/voters). Fed hiked rate last on 26th July’23 and may continue to be on hold till at least July’24; i.e. around 12 months for full transmission of its +5.25% cumulative rate hikes effect into the real economy.

Overall, the Fed’s mandate is to ensure price stability (2% core inflation), and maximum employment (below 4% unemployment rate) along with financial/Wall Street stability as well as lower borrowing costs for the government. As the US is now paying almost 15% of its tax revenue as interest on debt, the Fed will now not allow the 10Y US bond yield above 4.50-5.00% at any cost.

Bottom line:

Fed may continue QT (even at a slower pace) and go for a rate cut cycle at the same time despite these two policy actions being contradictory. Thus the Fed may go for rate cuts of -75 bps cumulatively in September, November, and December’24 for +4.75% repo rates from the present +5.50%. Fed may bring down further its B/S size from present around $7.5T to $6.55T through QT tapering by May-Dec’25 to keep minimum/ample liquidity for the US funding/money market and also to prepare itself for the next cycle of QE, whatever may be the recession excuse.

The market is now expecting 5 rate cuts (-125 bps) in 2025 against the Fed’s official 2-3 rate cuts; the Fed may go for 4 rate cuts in 2025 if Trump comes to power/White House or even under Biden. Fed’s mandate is now 2% price stability (core inflation), below 4% unemployment rate, and below 4.75-5.00% US 10Y bond yield to ensure lower borrowing costs for the government and overall financial stability.

Market impact:

On Friday Wall Street Futures, Gold, UST/US bond slid, while USD jumped after hotter than expected US core CPI/inflation report as the market is now implying -75 or even -50 bps rate cuts from September or even October’24. Before the inflation report Wednesday, the market was expecting June-July mostly and September partially; but began to imply a higher probability for the Sep’24 rate cut against June-July. The US10Y bond yield surged to +4.55% and approaching the Fed’s red line zone of 4.75-5.00%. Wall Street Futures were also under stress as the U.S. warned about an imminent missile/drone attack by Iran on Israel.

On Friday, Wall Street was dragged by real estate, utilities, materials, banks & financials, consumer discretionary, healthcare, industrials, techs, consumer staples, and communication services, while also supported by energy ( as oil surged on the escalation of Iran-Israel saber rattling). Gold also recovered from around 2019 to 2346 before closing around 2335. Dow Jones (DJ-30) was dragged by most of the stocks except Walmart, Chevron, P&G, Travelers, Amazon and Caterpillar.

Technical trading levels: DJ-30, NQ-100 Future, and Gold

Whatever may be the narrative, technically Dow Future (38684), now has to sustain over 38550 for a rebound to 39500-40000/40200-40600/40700 to 42600 levels in the coming days; otherwise, sustaining below 38500-38350/38295*, may again fall to 37950/37700-37600 and 37050-35550 levels in the coming days.

Similarly, NQ-100 Future (18165) now has to sustain over 18000 for a rebound to 18500-18750 and 19000/19200-19450/19775 and 20000/20200 in the coming days; otherwise, sustaining below 18000, NQ-100 may gain or fall to around 17800/17575*-17150/16850 and 16650/16490-15900/15700 in the coming days.

Also, technically Gold (XAU/USD: 2300 now has to sustain over 2335 for any further rally to 2355/2375*-2400/2425; otherwise sustaining below 2325, may again fall to 2320/2315-2305/2300 and 2290/2270-22245/2240, and 2220/2210-2200/2195-2190/2180 and 2175/2145*, and further to 2120/2110-2100/2080-2060/2039 and 2020/2010-2000-1995/1985-1975 and even 1940 may be on the card.

The materials contained on this document are not made by iFOREX but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.