This website uses cookies and is meant for marketing purposes only.

The US Dollar traded between gains and losses on Wednesday, ending the session unchanged as traders look ahead to a series of news releases due later this week including US GDP numbers, a speech by Fed chairman Jerome Powell and the long-awaited core PCE price index. Bets for a rate cut in June are currently at 55% according to the CME Fedwatch tool on Thursday, as U.S. growth prospects remain upbeat.

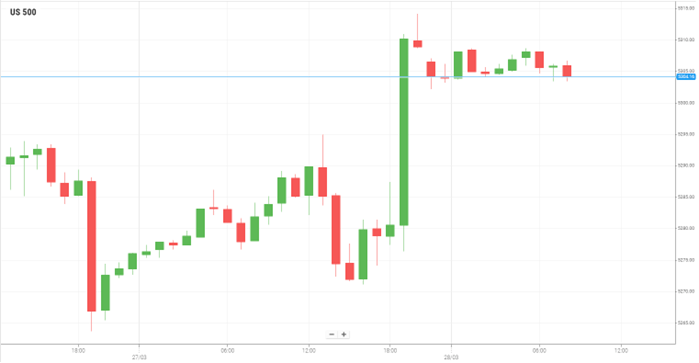

In Wall Street, sentiment remains strong as the US 30 and the US 500 showed gains, trading right below their record levels, while the US tech 100 was unchanged. The move was supported by a decline in treasury yields ahead of closely anticipated remarks from Fed governor Waller even though consensus he may keep a hawkish tone.

In corporate news Carnival Corporation gained 1% after reporting better-than-expected first quarter earnings results, and lifted its full-year earnings estimate to 98 cents per share from 93 cents. GameStop posted a sharp decline of 15% after the video game retailer reported a drop in fourth-quarter revenue due to a spending slowdown and rising competition. In pharmaceuticals, company Merck jumped 5% to a new record high after the U.S. Food and Drug Administration approved its treatment for a rare lung disease.

On the quarterly earnings calendar is Walgreens Boots, where investors are looking for major changes in the company’s strategy as shares continue to plummet. So far in 2024, the stock has tumbled about 20%.

Personal consumption expenditures (PCE) and speeches from Fed officials, Chair Jerome Powell and FOMC committee member Mary Daly due on Friday are this week’s highlights. The core PCE index is expected to rise 0.3% in February, which would keep the annual pace at 2.8%. In today’s session, some price action could be observed upon the release of GDP numbers from the US along with US unemployment claims, the Chicago PMI, pending home sales, and a university of Michigan survey on consumer sentiment and inflation expectations.

EUR/USD edges lower on Wednesday ending the session 0.18% lower on the back of diverging commentary from policymakers at the US Federal Reserve and European Central Bank.

ECB officials are now indicating a high likelihood the bank will cut interest rates in June, whilst mixed comments from Fed officials suggests a delay from the Fed is still reasonable.

In the US economic docket, investors will eye the release of Gross Domestic Product (GDP) figures for the last quarter of 2023, unemployment claims.

Gold prices gained 0.52% on Wednesday, as market participants awaited a key U.S. inflation data later this week, which could provide more clues on the Federal Reserve's policy path.

Gold hit a record high last week after the U.S. Fed anticipated three rate cuts in 2024 despite recent high inflation readings.

Anticipation of key PCE price index data- which is the Fed’s preferred inflation gauge- and comments from top Fed officials later this week also spurred flows into the dollar, especially as traders awaited more cues on U.S. interest rate cuts.

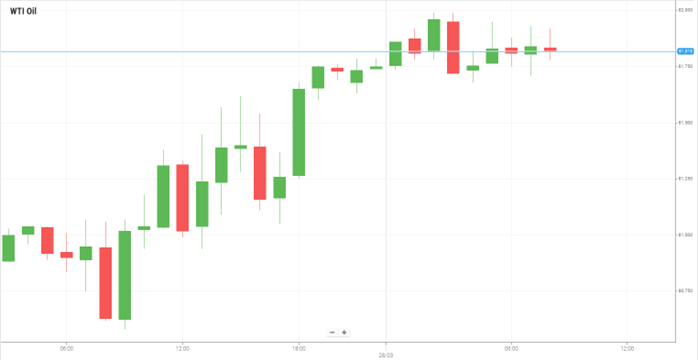

Oil prices trimmed losses and ended the session with moderate gains on Wednesday as bets on tighter supplies, especially amid lower Russian production, put crude on course for a strong first quarter in 2024.

A surprise jump in U.S. crude and gasoline stockpiles added pressure on oil prices. U.S. crude oil stocks rose by 3.2 million barrels while gasoline stocks rose by 1.3 million barrels in the week ended March 22, according to data from the Energy Information Administration.

Prices were boosted chiefly by a tighter outlook for markets, as Russia, Saudi Arabia, and other members of the Organization of Petroleum Exporting Countries (OPEC) kept ongoing production curbs in place. Russia had earlier in March said it will deepen its ongoing production cuts, while fuel supplies in the country also shrank following a series of debilitating attacks by Ukraine on Russian fuel refineries.

U.S. stocks were higher on Wednesday, with the US 30 leading gains while investors looked towards the next piece of inflation data and Federal Reserve commentary for signals on the rate path. At the close, US 500 and US 30 ended the session 0.53% and 0.85% higher respectively while US Tech 100 posted minor losses of 0.05%.

Merck & Co advanced almost 5% as the best performer on the US 30 after the U.S. Food and Drug Administration approved its therapy for adults suffering from a rare lung condition.

Markets were now awaiting more cues on inflation from PCE price index data- which is the Fed’s preferred inflation gauge. The data is due on Friday, when markets will be closed, but is largely expected to factor into the outlook for U.S. interest rates. Along with the PCE data, addresses from Fed Chair Jerome Powell and FOMC member Mary Daly are also due on Friday.

The materials contained on this document should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.