This website uses cookies and is meant for marketing purposes only.

The US Dollar showed little change on Tuesday, with the dollar index (USDX) ending the session slightly higher, while further upwards momentum is displayed early on Wednesday. Dollar traders appear to remain on the sidelines ahead of a series of news releases due later this week including US GDP numbers, a speech by Fed chairman Jerome Powell and the long-awaited core PCE price index which is considered to be the Fed’s favourite inflation indicator.

Bets for a rate cut in June are currently right above 60% according to the CME Fedwatch tool, as U.S. growth prospects in the first quarter remain upbeat. Orders for durable U.S. manufactured goods increased more than expected in February, while U.S. consumer confidence fell to the lowest level since November.

In other news, Cocoa prices soared by more than 8% on Tuesday, hitting record levels above ten thousand dollars per unit early on Wednesday with major chocolate companies starting to use hedging strategies to manage the price volatility and avoid passing on higher prices to consumers. According to reports, the move came as the world faces the worst supply deficit in decades, with farmers in West Africa struggling against bad weather, disease and failing trees.

In Wall Street, sentiment remains strong as all three main indices pared gains and US 500 and US tech 100 ended the session in the negative on Tuesday as investors assess mixed data from the U.S. and ahead of further remarks from Federal Reserve speakers and key inflation numbers due later this week. Fed members projected three cuts for this year, but some believe that could be reduced.

In corporate news Tesla stock rose 3%, with the electric carmaker set to offer U.S. customers a month's free trial of its driver-assist technology, Full Self-Driving, CEO Elon Musk said on Monday.

Personal consumption expenditures (PCE) due on Friday is this week’s highlight, with the index expected to rise 0.3% in February, which would keep the annual pace at 2.8%. In today’s session, some price action could be observed upon the release of CPI numbers from Spain, crude oil inventories from the US and earnings from Carinval (CCL).

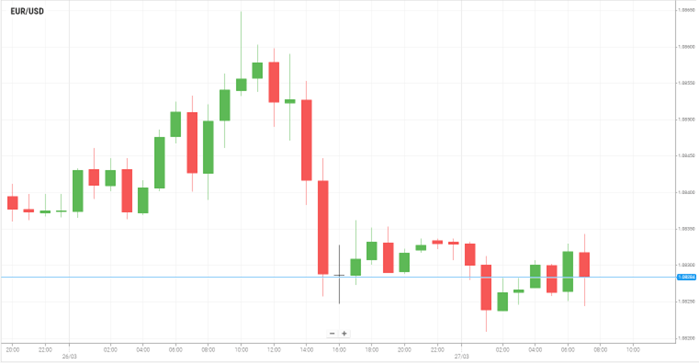

The EUR/USD pair traded between gains and losses on Tuesday and ended the session 0.04% lower amid a stronger dollar.

The US Census Bureau revealed that Durable Goods Orders for February rose 1.4% MoM. Furthermore, the Conference Board (CB) revealed that Consumer Confidence was steady in March, yet it ticked down to 104.7 from 104.8, a downward revision from the previous month.

On Tuesday, ECB official Yannis Stoumaras commented that there is a consensus for a June rate cut. Madis Muller echoed some of his comments, indicating that the ECB is nearing the stage where it can lower rates.

On the other hand, Fed officials continued to lay the groundwork for easing policy, but there’s division among the Federal Open Market Committee (FOMC) board.

Gold prices ended the session with gains of 0.30%, as expectations of interest rate cuts by the U.S. Federal Reserve firmed, while investors waited for data due later in the week for underlying inflation trends that will help gauge the timing of these cuts.

Market focus is on the U.S. Core Personal Consumption Expenditure Price Index data PCE due on Friday.

Gold prices also continue to find support from elevated physical demand from Chinese households, where gold's record rally has not tarnished the buying appetite.

Oil prices settled lower on Tuesday with WTI ending the session 0.93% lower as investors took a more mixed view toward the loss of Russian refinery capacity after recent Ukrainian attacks.

Trading was muted ahead of data that could provide insight into when central banks may begin interest rate cuts. The crucial February reading of the Personal Consumption Expenditures price index, the U.S. Federal Reserve's preferred inflation gauge, is due on Friday.

U.S. crude oil and distillate inventories rose last week, while gasoline stockpiles fell, according to market sources citing American Petroleum Institute figures on Tuesday. Official government data will be published later today.

U.S. main indexes posted a mixed picture on Tuesday as investors awaited economic data in a holiday-shortened week to gauge the Federal Reserve's policy path. US 500 and US Tech 100 ended the session 0.15% and 0.28% lower respectively while US 30 gained 0.12%.

Stocks struggled for upward momentum even as Tesla gained more than about 3% after CEO Elon Musk unveiled the electric-vehicle maker's one-month trial of its Full Self-Driving technology to existing and new customers in the United States.

On the economic front, orders for long-lasting U.S. manufactured goods increased more than expected in February, while business spending on equipment showed tentative signs of recovery. The focus remains on a key reading of the Personal Consumption Expenditures Price Index (PCE), the Fed's preferred inflation gauge.

The materials contained on this document should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.