This website uses cookies and is meant for marketing purposes only.

Wall Street was already under pressure on fading hopes of an early Fed pivot amid hawkish Fed talks coupled with an escalating war of words between Israel and Iran after a war of friendly drones/missiles on the weekend. On early Friday Asian session, Gold spiked to almost 2418 from around 2375, while oil jumped to almost 86.50 from around 82.50 Dow Future plunged from around 38100 to almost 37500 and S&P 500 futures fell 60 points after news that Israel indeed launched the limited retaliation drone attack on harmless Iranian target (after duly informing US/Iran).

This war drama follows a similar retaliation by Iran last Friday night, which looked like a badly scripted Hollywood war/spy thriller than any real war. In any way, by the early European session Friday, Wall Street Futures recovered, while Gold also stumbled as Iran downplayed the ‘anonymous internal drone attack’ and does not want to escalate further by launching another Hollywood-style Drone thriller.

But NQ-100 (Nasdaq) Future again stumbled from around 17550 to 17100, before closing around 17185, tumbling over -2%, primarily dragged by Netflix and NVIDIA amid subdued guidance. Also, Microsoft, Apple, Amazon, Meta and Tesla (vehicle safety concern) dragged, while Dow Jones was primarily boosted by American Express (upbeat report card) and P&G (better-than-expected revenue).

P&G Q3 2024 Earnings:

· Core EPS $1.52, est. $1.41

· Net sales $20.20b, est. $20.43b

· Raises EPS growth guidance

· Sees FY Core EPS growth +10% to +11%. saw +8% to +9%

· Still sees FY organic rev. +4% to +5%, est. +4.66%

American Express Q1CY24 Earnings:

· EPS $3.33, est. $2.96

· Rev. $15.80b, est. $15.77b

· Still sees FY EPS $12.65 to $13.15, est. $12.83

· Still sees FY rev. +9% to +11%

· Provision for credit losses of $1.3b

Also lingering geopolitical tensions over Iran-Israel ‘war drills’ are affecting risk trade. As per Fox reports, the target of the Thursday late-night Israeli strike in Iran was a military base in Isfahan near Natanz, not the nuclear facilities, but the Russian-made Air Defense system protecting the nuclear facilities. As per US military sources, the Israelis hit what they intended to strike; there was one main target that was hit multiple times and Iran’s Russian-made air defense system was proven ineffective. The targets of the strike included air defense systems at the military base, which is used to protect the nearby nuclear facilities. The IDF used missiles and drones in the strike without any payloads and not manned aircraft. Israel’s message to Iran was that ‘we can reach out and touch you’.

As per reports, there were three missiles launched, and they hit an Iranian air defense system near one of the nuclear facilities near Isfahan. This is part of Israel’s strategic signaling that it has sophisticated capabilities as Israel was able to suppress Syrian air defenses, went through Iraqi air defenses unscathed and managed to reach an air defense system very close to an Iranian nuclear establishment. The same strategy Iran seems to have taken when hundreds of drones and missiles (without real payloads) went through Jordan, Syria and Iraqi air spaces and were able to hit almost Israeli territory. In any way, the approval rating of Israeli PM Netanyahu improved significantly after the Iran strike (although officially neither Israel nor the U.S. acknowledged it) and Netanyahu’s poll prospect is now almost comparable with his arch-rival, the Defense Minister Gallant of his war cabinet.

The market is now concerned about any miscalculation over this ongoing war game in the Middle East, which may cause an all-out regional war or even ignite the next mini WW. Although the U.S. (Biden admin) is trying for a workable Gaza War ceasefire ahead of Nov’24 election, there is some deadlock. Hamas officials called for expanding engagement against Israel over the war of genocide in Gaza and escalation in the region.

On Friday, the CIA chief Burns blamed Hamas for the latest deadlock on the hostage negotiations, which rejected the latest ceasefire proposal crafted by US, Qatari, and Egyptian mediators: “It was a deep disappointment to get a negative reaction from Hamas. Right now, it’s that negative reaction that is standing in the way of innocent civilians in Gaza getting the humanitarian relief that they so desperately need. And it breaks your heart because you can see in very human terms what’s at stake here as well”.

On Friday, the US Secretary of State Blinken said:

· The US has not been involved in any offensive operations but does not confirm Israel’s alleged strike on Iran

· We cannot support a major military operation in Rafah by Israel

· We believe Israel's objectives can be achieved without Rafah's offensive

· Conversations on Rafah at senior levels with Israel continue

· We are committed to achieving a Palestinian state with necessary guarantees for Israel (after vetoing the UN resolution about Palestine's statehood last night)

· The US has not seen the direct supply of weapons from China to Russia but has seen the critical supply of inputs and components

Now from geopolitics to economics, on Friday, Chicago Fed President Goolsbee said:

· Progress on US inflation has stalled

· We have done great on the employment mandate but we have not succeeded on the inflation mandate

· I don't know if recent inflation is a sign of overheating

· When asked about a possible rate hike: I don't think anything is not on the table

· The Fed is figuring out how restrictive it needs to be

· If productivity continues, it will change everything

· Consumer loan delinquencies are an area of concern

· There are some measures in the economy, that historically don't portend well

· We will get inflation to 2% over a reasonable period

· Not all data suggests the labor-market overheating

· It makes sense to wait to get more clarity before moving

· I see more space for progress on service inflation from labor supply increases

· Persistently high housing inflation is the main short-run problem

· I am still hopeful for a return to improvement in inflation in the months ahead

· Proper Fed policy going forward will depend on the data

· The Fed's current restrictive monetary policy is appropriate

· The golden path is more difficult for 2024

· If you hold at this level of restrictiveness for too long, you will have to start thinking about the impact on jobs

· The policy tradeoffs are harder this year

· It is harder to get to 2% inflation absent housing progress

· We will get inflation to 2% over a reasonable period

Overall the Fed is now preparing the market for rate cuts from Sep’24 or even no rate cuts in 2024; the Fed should not go for an early rate cut, while the economy is firing on almost all cylinders. Fed should hold for now and go for rate cuts when disinflation gets more momentum and there are some signs of labor market stress. For the time being, the Fed could continue to do the QT to bring B/S size down to around $6.60T and be ready for the next round of QE/QQE/Rate cuts. Fed may go for an early rate cut if the US labor market worsens unexpectedly or the rate of disinflation accelerates suddenly.

Market impact:

On Friday, Wall Street Futures closed mixed as the recovery from the Iran-Israel duet panic low was not sustainable for NQ-100 and also SPX-500 due to the slide in techs amid subdued guidance by Netflix and NVIDIA, while DJ-30 was boosted by an upbeat report card/guidance by AXP (American Express). Wall Street was dragged by techs, communication services, consumer discretionary, industrials, and materials, while boosted by utilities, banks & financials, energy, consumer staples, real estate and healthcare. For the week, the broader SPX-500 500 tumbled -3.8%, the worst week in almost six months. Tech-heavy NQ-100 plunged -6.1% to mark its longest losing streak in over a year and blue-chip DJ-30 slumped -0.9%.

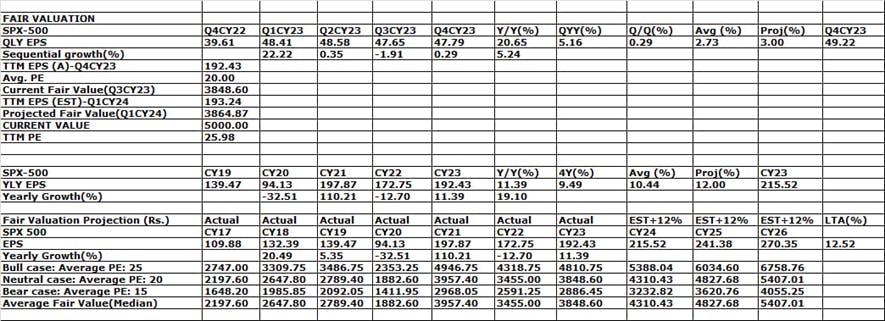

Fair Valuation: SPX-500 (S&P 500)

S&P 500 reported an actual EPS of 47.79 in Q4CY23 and 192.43 for CY23 against 172.75 in CY22; i.e. yearly growth of around +11.39% against long-term average growth rate around +12.50%. At an average CAGR of around +12% for CY: 24-26, the estimated EPS would be around 215.52, 241.38, and 270.35. Assuming a fir PE of 20, the estimated fair value of SPX-500 would be around 3849 for CY23, 4310 for CY24, 4828 for CY25 and 5407 for CY26. As the financial market usually discounts at least 12 months of EPS in advance, the fair value of SPX-500 should be around 4828 by CY24 and 5407 by CY25.

The SPX-500 has already scaled around 5340 in mid-March on hopes & hypes of an early Fed pivot and AI chip optimism; i.e. running much ahead of fundamentals. Looking ahead, the S&P 500 should hover around 4800-5400 for CY24 against the present price of around 4967; if there is any unusual bearish event/development, then the S&P 500 may further fall to around 4600-4300 and even 4000 levels (whatever may be the excuses). Overall, the present PE ratio of DJ-30 (Dow Jones Industrial Average) is now around 26.52 against a mean/fair PE of 20, while Nasdaq-100 (NQ-100) has a present PE of around 29.72 against a median/fair PE of 22 and S&P 500 has present PE around 26 vs mean/fair PE of 20.

Technical trading levels: DJ-30, NQ-100 Future, and Gold

Whatever may be the narrative, technically Dow Future (38200), now has to sustain over 38350 for a further rally to 38500/38700* and 38800/39050-39200/40000-40200/40425-40600/40700 to 42600 levels in the coming days; otherwise, sustaining below 38300/38050-37650/37500*, may further fall to 37400/37200-37050/36600 and 36300/36300 and even 35700 levels in the coming days.

Similarly, NQ-100 Future (17185) now has to sustain over 17100/17250-17550/17650 for a rebound to 17800/17900-18100/18250 and 18550/18700-18800/18900-19000/19200-19450/19775 and 20000/20200 in the coming days; otherwise, sustaining below 17050-17000, NQ-100 may further fall to around 16800/16595*-160000/15800 in the coming days.

Technically, SPX-500 (5004), now has to sustain over 5100 for any recovery to 5155/5225-5255*/5375 in the coming days; otherwise, sustaining below 5075 may fall to 4950/4900*-4850/4825 and 4745/4670-4595/4400* in the coming days.

Also, technically Gold (XAU/USD: 2392) now has to sustain over 2400/2410-2425/2435* for any further rally to 2455-2475/2500; otherwise sustaining below 2395, may again fall to 2375/2350 and 2320/2315-2305/2300 and 2290/2270-22245/2240, and 2220/2210-2200/2195-2190/2180 and 2175/2145*, and further to 2120/2110-2100/2080-2060/2039 and 2020/2010-2000-1995/1985-1975 and even 1940 may be on the card.

The materials contained on this document are not made by iFOREX but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.