This website uses cookies and is meant for marketing purposes only.

On Friday, Wall Street Futures, Gold, and UST/US bond wobbled on Iran’s plan of a calibrated/friendly Israel attack (with advance information) to avoid an all-out regional war and also to satisfy all stakeholders. Overall, the one-and-done Iran attack Saturday night on Israel (looks like a well-informed live war drill or a badly scripted Hollywood movie between Iran and Israel/US/UK) may be negative for Gold and oil and positive for Wall Street futures (equities). Thus on early Monday, Wall Street Futures recovered to some extent, while Gold slipped further to around 2345.

Although Israel's war cabinet is still debating how to ‘respond’ to Iran's attack, US President Biden informed Israeli PM Netanyahu that the US will oppose any Israeli counterattack against Iran, while China urges influential countries to help maintain regional peace and stability. Iran’s IRGC said it has ‘successfully hit important military targets of Israeli army Negev and destroyed important military infra’. IRGC also ‘warned’ the US against any support for Israel or involvement in harming Iran’s interests. IRGC said: Operation 'True Promise' is part of the punishment for Israeli crimes.

Late Friday, after launching the ‘mother of all retaliatory attacks through hundreds of missiles and drones, Iran's Mission to UN on X tweets: “Conducted on the strength of Article 51 of the UN Charter pertaining to legitimate defense, Iran’s military action was in response to the Zionist regime’s aggression against our diplomatic premises in Damascus. The matter can be deemed concluded. However, should the Israeli regime make another mistake, Iran’s response will be considerably more severe. It is a conflict between Iran and the rogue Israeli regime, from which the U.S. MUST STAY AWAY!”

On Monday, Iran's foreign minister Abdollahian said:

· Tehran informed regional neighbors 72 hours before attacks on Israel

· Informed US that attacks on Israel will be "limited" and for self-defense

· Tehran has no intention to extend its defensive operations

On Monday, the U.S. Defence Secretary Austin said:

· We will protect our forces and support the defense of Israel but do not seek conflict with Iran

· Urges Iran to reduce tensions, stating that the US does not intend to go to war with Iran

From geopolitics to economics:

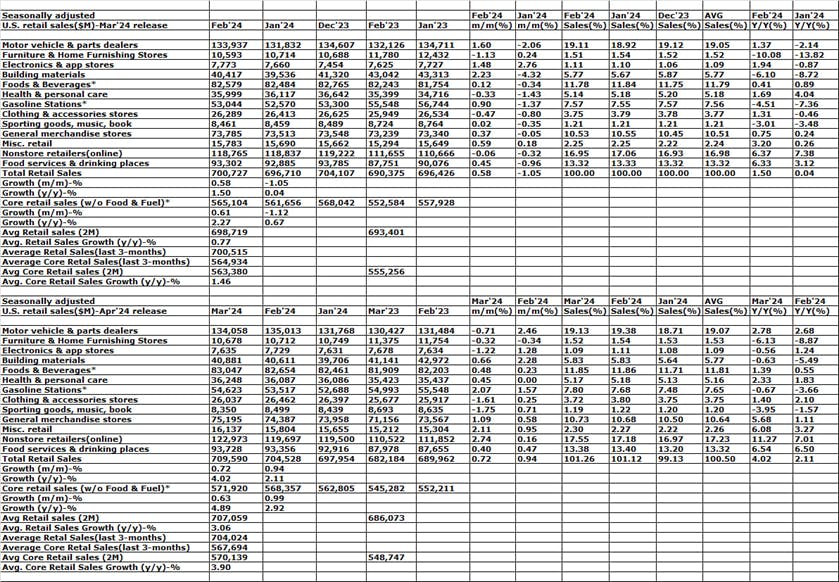

On Monday, some focus of the market was also on US retail sales as consumer spending is the backbone of the US economy and the Fed also watches this data closely for an assessment of overall economic activities. On Tuesday, the CB flash data showed seasonally adjusted U.S. retail sales for Mar’24 were around $709.590B against 704.628B sequentially (+0.72%) and 682.184B yearly (+4.02%); i.e. the U.S. retail sales surged +0.7% sequentially (m/m), higher than the market consensus of +0.3% growths, and +4.0% annually (y/y) in Mar’24.

In Mar’24 US retail sales flash data, 8 out of 13 categories posted increases. Major increases were seen in sales at non-store retailers (+2.7%), gasoline stations (+2.1%), miscellaneous store retailers (+2.1%), and building materials and garden equipment (+0.7%). Gains were also recorded at food and beverages stores (+0.5%), health and personal care stores (+0.4%), and food services and drinking places (+0.4%). On the other hand, sales were down for sporting goods, hobbies, musical instruments, & book stores (-1.8%), clothing (-1.6%), electronics and appliances (-1.2%), general merchandise stores (-1.1%), autos (-0.9%) and furniture (-0.3%). Excluding food services, auto dealers, building materials stores and gasoline stations, the so-called super core retail sales which are used to calculate consumer spending in GDP, jumped +1.1%, indicating hotter GDP. U.S. Retail sales are adjusted for seasonality but not for price changes (inflation).

Overall, after the latest positive revisions the average retail sales is now around $704.02 in 2024 (till March flash data) against the 2023 average of $695.260B. The US retail sales nominal growth is still strong despite higher borrowing costs and higher cost of living as the labor market is still robust, while the lagging effect of huge fiscal stimulus (COVID) is still prominent. Adjusted inflation (CPI), the underlying real retail sales has contracted around -1.37% in 2023 against +3.65% in 2022. In 2024 (YTM), the real retail sales contracted around -1.78%.

On Monday, NY Fed’s President Williams said:

· I'm getting more optimistic about potential growth

· I do think we have a restrictive monetary policy

· My view is that rate cuts will likely start this year

· Monetary policy is in a good place

· The latest CPI is important information affecting forecasts

· Markets are taking slower inflation progress into account

· I don't see the recent inflation data as a turning point

· I think the economy will continue to grow at a solid rate

· Getting a strong tailwind from the supply side

· Consumer spending is driven by strong fundamentals

On late Monday, the SF Fed President Daly popped up again and said:

· Significant progress on inflation, but still not there yet

· Solid economic growth, strong labor market, and inflation above target

· No need to lower interest rates urgently

· Backward-looking to only consider published information

· Confidence in inflation reaching the target necessary before reacting to above-target levels

· Warned against unnecessary urgency to cut rates

· Cautions against overly strong or weak policy response

· Inflation Bumps Along the Way Not Particularly Surprising

· Inflation data lacks surprise

· Opposes changing the 2% inflation goal post before accomplishing it

· No direct impact of geopolitical tensions on our economy so far

· Doesn't know if r* has risen; R-star likely between 0.5 and 1.00% (neutral real policy rate)

· Uncertain if R-Star Has Increased

· Upside surprise in labor force supply, but can't rely on it for policy-making

· Inflation bumps along the way are not particularly surprising

· More housing is needed to solve the housing problem, bridling inflation won't help

· Backward-looking to only consider published information

· Confidence in inflation reaching the target necessary before reacting to above-target levels

On Monday, Dow Future was also buoyed by an upbeat report card from Goldman Sachs in Q1CY24:

· Net Rev. $14,21B, est. $12.98B

· EPS $11.58 vs $8.79 YoY

· FICC sales & trading rev $4.32B, est. $3.64B

· Advisory rev $1.01B, est. $874.4M

· Platform solutions pretax loss $117M, est. loss $260.5M

· Total deposits $441B, +3% Q/Q

· Loans $184B, est. $185.39B

· Provision for credit losses $318M, est. $503.4M

· Net interest income $1.61B, est. $1.47B

· Investment banking rev. $2.09B, est. $1.82B

· Equities sales & trading rev $3.31B, EST. $2.96B

· Global banking & markets net rev. $9.73B, est. $8.46B

· AUM $2.85T, est. $2.92T

Market impact:

On Monday, Wall Street Futures stumbled, while Gold surged again amid an escalating war of words (scripted) between Iran and Israel in line with their respective domestic political compulsions. Israel Defense Minister Gallant said it has no choice but to respond to Iran's attack. On the other side, Iran's Foreign Minister told his British Counterpart: “Tehran does not favor increased tension but it will respond instantly and stronger than before if Israel retaliates”.

Iraq is now also warning about regional escalation and Israel also reserved its right to self-defense after the ‘unprecedented’ Iranian attack. Iran said it would respond to a possible Israeli retaliatory attack 'within seconds'. The market is concerned that Israel's response to the Iranian attack may be imminent, as Iran's attack on Israel sparks global concerns of regional escalation despite Iran’s Friday weekend retaliation to Israel’s earlier strike may be Pure Political Theater or a badly scripted Hollywood war/spy thriller.

Senior Israeli officials have declared a delay in the ground invasion of Rafah in Southern Gaza until an Israeli response against Iran has been concluded. Israel Defense Minister Gallant said it has no choice but to respond to Iran's attack, while Saudi Arabia's Foreign Minister calls on China to play an active role in returning to the normal track of the escalating situation in the Middle East. On Tuesday, the Chinese and Iranian foreign ministers spoke and Iran's foreign minister reportedly said willing to exercise restraint. Iran is willing to show restraint, with no intention of further escalation.

On Monday, blue chip DJ-30 slumped around -0.65%, while broader SPX-500 and tech-savvy NQ-100 tumbled around -1.2% and -1.79% respectively, while US10Y bond yield surged to +4.60%, the highest levels since Nov’23 amid hotter than expected US retail sales and escalated war of rhetorics/words between Iran and Israel. Wall Street was dragged by almost all the major sectors led by techs, real estate, communication services, consumer discretionary, utilities, energy, industrials, banks & financials, materials, consumer staples and healthcare. Wall Street was boosted by Goldman Sachs (upbeat report card), Intel, United Health, Nike, Verizon, Merck, JPM, and American Express, while dragged by Salesforce, Apple, Microsoft, Visa, Home Depot, Amazon, Honeywell, Boeing, Walt Disney, Chevron, Amgen, caterpillar and IBM.

The 6M rolling average of US core inflation (PCE+CPI) is now around +3.5%. Fed may cut 75 bps in H2CY24 if the 6M rolling average of core inflation (PCE+CPI) indeed eased further to +3.0% by H1CY24. The Fed wants to keep the real/neutral rate around +1.0% in the longer term (assuming +3.0% repo rate and +2.0% core inflation). But in the meantime, till core inflation/headline inflation goes down to around 2.00% on a sustainable basis, the Fed wants to maintain the real rate at around present restrictive levels of +1.50% (assuming the present repo rate +5.50% and 2023 average core CPI around +4.00%).

As per Taylor’s rule, for the US:

Recommended policy repo rate (I) = A+B+(C-D)*(E-B)

=1.50+2.00+ (2.60-2.00)*(4.50.00-2.00) =1.00+2+ (0.60*2.50) = 3.00+1.50=4.50% (By Dec’24)

Here:

A=desired real interest rate=1.50; B= inflation target =2.00; C= Actual real GDP growth rate for CY23=2.6; D= Real GDP growth rate target/potential=2.00; E= average core CPI+PCE inflation for CY23=4.50

The Fed may go for -75 bps rate cuts in September, November, and December’24. By 18th September (Fed MPC date), the Fed will have complete data for core inflation and also unemployment/real GDP data for H1CY24 and also Aug/July’24 to have the required ‘higher confidence’ to go for rate cuts. Fed may bring down the repo rate to +4.75% by Dec’24 from present +5.50%.

Fed may announce a plan for QT tapering/trajectory/closing in the May meeting and should have closed the same before going for any rate cuts cycle. Fed, the world’s most important central bank may not continue QT (even at a reduced pace) and go for rate cuts at the same time as QT, and rate cuts are contradictory (like QE and rate hikes). But Fed/Powell kept that absurd option of simultaneous QT and rate cuts open, at least theoretically. Thus assuming a bizarre phenomenon, the Fed may go for -75 bps rate cuts in H2CY24, most probably from Sep’24 after deciding about the possible B/S size to ensure money market stability

Looking ahead, the Fed may keep B/S size around $6.60T, around pre-COVID levels to ensure financial/Wall Street stability along with Main Street stability (price stability and employment stability). Fed’s B/S size is presently (Mar’24 end) around $7.48T around 25% of estimated nominal GDP for $30T by Dec’24. Depending upon the actual rate/reaction in the repo/funding market, the Fed may taper the QT from the present $0.095T/M to 0.050-0.075T/M for 18-12 months from May’24;i.e. Fed may end the QT by May’25-Dec’25 at B/S size around $6.60T. This is lower than the earlier market estimate of $7.00T and thus should be seen as more hawkish. Also, rate cuts along with QT (even with slower pace/tapering) should be less hawkish.

Ahead of the Nov’23 U.S. Presidential election, White House/Biden/Fed/Powell is more concerned about elevated inflation rather than the labor market; prices of essential goods & services are still significantly higher (around +20%) than pre-COVID levels, which is creating some anti-incumbency wave (dissatisfaction) among general voters against Biden admin (Democrats) on some economic issues (higher cost of living).

Thus Fed is now giving more priority to price stability than employment (which is still hovering below the 4% red line) and is not ready to cut rates early as it may again cause higher inflation just ahead of the November election. Fed may hike only from Septenber’24, which will ensure no inflation spike just ahead of the Nov’24 election (as any rate action usually takes 6-12 months to transmit in the real economy), while boosting up both Wall Street and also Main Street (investors/traders/voters). Fed hiked rate last on 26th July’23 and may continue to be on hold till at least July’24; i.e. around 12 months for full/proper transmission of its +5.25% cumulative rate hikes effect into the real economy.

Overall, the Fed’s mandate is to ensure price stability (2% core inflation), and maximum employment (below 4% unemployment rate) along with financial/Wall Street stability as well as lower borrowing costs for the government. As the US is now paying almost 15% of its tax revenue as interest on debt, the Fed will now not allow the 10Y US bond yield above 4.50-5.00% at any cost (against present levels of average core CPI around +4.0%).

But the Fed may also blink on rate cuts in H2CY24 just before the US election:

Ahead of Nov’24 US Presidential election, as evident in the last Congressional testimony, the Fed is under huge pressure from opposition Republican lawmakers (Trump) and also supporters for ‘assisting’ Biden admin (Democrats) in booting the election win probability by facilitating rate cuts. Thus Fed may not go for any rate cuts till Nov’24 or even Dec’24 to show that it’s politically independent. In the meantime, the Fed may close the QT at the present pace of around -0.095T/M for the next nine months (April-Dec’24) for the targeted ample B/S size around $6.60T (@22% of CY24 nominal GDP around $30T, just above 20% minimum requirement of $6.00T).

The most logical step would be Fed to close the QT completely before going for a rate cuts cycle and then go for any QE, if required to counter another economic crisis down the years. Fed has to prepare its B/S for the next round of QQE and thus has to normalize the B/S first.

Now going by various Fed comments in the last few weeks, it seems the Fed is ‘extremely’ worried about the pace of slower disinflation. Fed is also apparently confused about the dual combination of QT, even at a slower pace (QT taper) and rate cuts in the months ahead as these two instruments (tools) are contradictory/opposite (like if Fed goes for QE and rate hikes at the same time). Ideally, the Fed should finish the QT first for a proper B/S size (bank reserve) to ensure ample liquidity for the US funding/money/REPO market.

But the Fed may continue QT (even at a slower pace) and go for a rate cut cycle at the same time despite these two policy actions being contradictory. Thus the Fed may go for rate cuts of -75 bps cumulatively in September, November, and December’24 for +4.75% repo rates from the present +5.50%. Fed may bring down further its B/S size from present around $7.5T to $6.55T through QT tapering by May-Dec’25 to keep minimum/ample liquidity for the US funding/money market and also to prepare itself for the next cycle of QE, whatever may be the next recession excuse.

The market is now expecting 3-2 rate cuts (75-50 bps) in 2024, while some Fed policymakers are now arguing for lesser rate cuts of 1-2 rate cuts or even no rate cuts at all. Looking ahead, the Fed may not cut rates at all in 2024 considering the slower rate of disinflation, political issues ahead of the Nov’24 election, and the logic that it should not go for any rate cuts while doing QT, which is the opposite. Also, the reduction of B/S from around $8.97T to around $6.60T (projected); i.e. around $2.50T (~$2.37T) reduction over 2.5-3.00 years is equivalent to a rate hike of around +50 bps (higher 2Y bond yield).

In that scenario, if the US core CPI average for 2024 comes down to around +3.00% by Dec’24 from present levels of +3.8%, the Fed may cut rates by -100 bps in 2025 for a repo rate +4.50% (from present +5.50%) for a real restrictive repo rate +1.50% (repo rate 4.50%-3.00% projected average core cpi for 2024). Presently, the real restrictive repo rate is also around +1.50% (repo rate 5.50%-4.00% average core CPI for 2023).

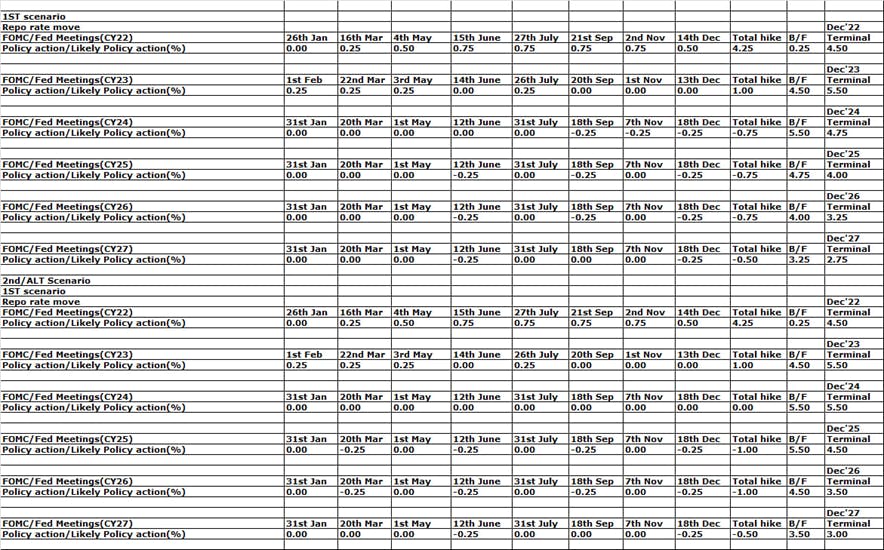

At present, in its last (Mar’24) SEP/dot-plots, the Fed projected -75 bps rate cuts each in 2024, 2025, and 2026 and -50 bps rate cuts in 2027 for a terminal neutral repo rate +2.75% against pre-COVID neutral repo rate +2.50%. Now various Fed policymakers are arguing for a slightly higher neutral repo rate at +3.00% against projected core CPI of +2.00%; i.e. neutral real rate at +1.00%.

Thus depending upon the actual trajectory of core CPI, the Fed may cut -100 bps each in 2025, 2026, and -50 bps in 2027 for a terminal neutral repo rate of +3.00% from the present +5.50%. Fed had boosted its B/S from around $3.86T in late September’2019 (after the QT tantrum) to around $8.97T in Apr’22; i.e. over $5T in a matter of 32 months (@0.16T/M) to fight previous QT and COVID induced financial crisis.

Now Fed may announce a plan for QT tapering from $0.095T/M to $0.075/M and end the QT by 15th Mar’25 around B/S size $6.60T before going for any rate cuts from mid-March’25; Fed may opt for four QTR rate cuts (-25 bps) each in each quarter in 2025, 2026 and two half yearly rate cuts in 2027 to ensure price/employment/financial stability. Although, the Fed’s official QT rate is -$0.095T/M ($90B/M), in reality, the effective average QT rate is already around -$0.073T/M. As the Fed is now managing the funding/money market through ON/RRP, there is a lower risk of a 2019 type of QT tantrum this time.

Fed’s mandate is now 2% price stability (core inflation), below 4% unemployment rate, and below 4.75-5.00% US 10Y bond yield to ensure lower borrowing costs for the government and overall financial stability. Fed, as well as ECB, BOE, and BOC, are now struggling to keep bond yield and inflation at their preferred range despite non-stop jawboning; perhaps they are talking too much too early and thus FX market is not being influenced by them significantly, moving in a narrow range. The BOJ is now trying to talk down the USDJPY desperately, presently hovering around 152 levels, causing higher imported inflation and a higher cost of living back home, although it may be beneficial for exports. However, most of the Japanese are not happy at all due to higher imported inflation in Japan for the devalued currency.

Bottom line:

Original scenario: -75 bps rate cuts each in 2024, 2025, 2026, and -50 bps in 2027 for a neutral repo rate of +2.75%

If the rate of disinflation accelerates, the Fed may go for -75 bps rate cuts each in 2024, 2025, and 2026 and -50 bps in 2027. Fed may continue the QT (even at an officially slower pace) and rate cuts at the same time (in 2024) despite being contradictory.

Alternate scenario: -100 bps rate cuts each in 2025, 2026, and -50 bps in 2027 for terminal neutral reo rate +3.00%

Fed may announce a plan for QT tapering from -$0.095T/M to -$0.075T/M from April’24 (even before the May’24 meeting) and close the QT by Mar’25 at B/S around $6.60T. Then Fed may start the rate cut cycle from Mar’25 with -100 bps rate cuts each in 2025, 2026 (@-25 bps at each QTR), and finally -50 bps in 2027 (@-25 bps in Q2 and Q4).

Technical trading levels: DJ-30, NQ-100 Future, and Gold

Whatever may be the narrative, technically Dow Future (37950), now has to sustain over 33750/38000-38350/38550 for a rebound to 39500-40000/40200-40600/40700 to 42600 levels in the coming days; otherwise, sustaining below 37650-37600, may further fall to 37400/37200-37050/36600 and 36300/36300 and even 35700 levels in the coming days.

Similarly, NQ-100 Future (17850) now has to sustain over 18000 for a rebound to 18500-18750 and 19000/19200-19450/19775 and 20000/20200 in the coming days; otherwise, sustaining below 18000, NQ-100 may gain or fall to around 17800/17575*-17150/16850 and 16650/16490-15900/15700 in the coming days.

Also, technically Gold (XAU/USD: 2385) now has to sustain over 2400-2425 for any further rally to 2455-2475/2500; otherwise sustaining below 2395-2390, may again fall to 2375/2350 and 2320/2315-2305/2300 and 2290/2270-22245/2240, and 2220/2210-2200/2195-2190/2180 and 2175/2145*, and further to 2120/2110-2100/2080-2060/2039 and 2020/2010-2000-1995/1985-1975 and even 1940 may be on the card.

The materials contained on this document are not made by iFOREX but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.