This website uses cookies and is meant for marketing purposes only.

The dollar posted moderate gains against most major currencies on Wednesday, with the USDX ending the session 0.12% higher. According to reports, the dollar is expected to remain supported against other major currencies since the tone of the Fed is more hawkish sounding than the ECB, BoE, BoC, and RBA. However, given Fed’s data driven approach for monetary policy planning, the upcoming PCE price index on Friday and U.S. GDP on Thursday will be closely watched.

Investors expect the Federal Reserve to be one of the last major central banks to cut rates, with the CME Fedwatch tool, currently pricing in a 16.4% for the first rate cut to occur in June, 37.1% to take place in July and 46.4% in September.

Wall street was hit by disappointing forecasts from megacap Facebook parent Meta Platforms, who send tech shares plummeting as the company's first-quarter earnings report raised fears that the surging cost of AI is outweighing its benefits. Meta stock took a dive of more than 15% as the company guided total revenue for Q2 to be in the range of $36.5B to $39B, or $37.75B at the midpoint, missing estimates of $38.3B. The weaker-than-expected revenue outlook comes as the company now expects higher 2024 capital expenditures to support its artificial intelligence roadmap.

For the week ahead, several key earnings reports are due, among which are Caterpillar, Valero, Check Point, Honeywell, Altria, American Airlines, Royal Caribbean, Newmont, Snapchat, Bristol-Myers, T-Mobile, Intel, Spectrum, Chevron, AbbVie and Exxon Mobil.

In other news, the yen fell to 155 per dollar for the first time since 1990 raising the possibility for a central bank intervention. Japanese Finance Minister Shunichi Suzuki and other policymakers have said they are watching currency moves closely and will respond as needed.

Investors are now looking ahead to the release of U.S. first-quarter gross domestic product data as well as the March figures for personal consumption expenditures, the Fed's preferred inflation gauge. Moreover, some price action could be seen upon the release of US jobless claims and pending home sales.

The Euro was steady against the US Dollar on Wednesday ending the session with minor losses of 0.03%.

The market mood shifted sour as the US Treasury yields edged up after a record $70 billion sale of five-year notes in the US fixed-income market.

In the meantime, the US Department of Commerce showed that US Durable Goods Orders increased in March, expanding by 2.6% MoM, up from a 0.7% rise previously and surpassing 2.5% estimates.

On the other hand, in Germany, data from the IFO Institute showed a greater-than-expected rise in the Business Climate and Current Assessment components.

Gold prices ended the day with minor losses on Wednesday as risk premiums over tensions in the Middle East eased, while investors strapped in for U.S. economic data due later in the week that could offer clues to the Federal Reserve's interest rate path. The gold market seems to experience a correction with a de-escalation in the Middle East conflict.

The U.S. gross domestic product (GDP) data is due on Thursday and the Personal Consumption Expenditures (PCE) report on Friday.

Market participants now expect the first Fed rate cut to come, most likely in September. Higher interest rates reduce the appeal of holding non-yielding gold.

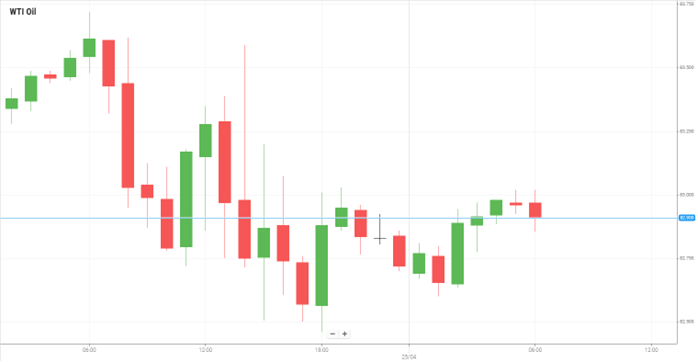

Oil prices settled lower Wednesday, as cooling tensions in the Middle East stifled bets on supply disruptions and signs of weaker gasoline demand overshadowed a much larger than expected decline in U.S. crude inventories.

Data from the Energy Information Administration showed Wednesday that U.S. oil inventories fell 6.4 million barrels in the week to April 19, confounding expectations for a build of 1.6 million barrels.

Even though the Iran-Israel tensions ease the Israel-Hamas war showed little signs of stopping, keeping some risks of Middle Eastern geopolitics still in play for crude markets.

U.S. stock indexes fell on Wednesday, with heavyweight technology stocks seeing renewed weakness after disappointing second-quarter guidance from Facebook owner Meta Platforms Inc.

Both the US 30 and the US tech 100 posted declines of 1.33% on Wednesday’s session while the US 500 fell by approximately 0.8% with Meta’s shares dropping by a sharp 15% in aftermarket trade to hit three-month lows. The move was mainly attributed to forecasts of weaker-than-expected revenue for the second quarter due to higher spending on artificial intelligence.

Focus this week was on upcoming gross domestic product data- due Thursday- and PCE price index data- due Friday. Both readings are expected to factor into the outlook for U.S. interest rates.

The materials contained on this document should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.